In Every Tragedy Lies Opportunity

It’s important to know how to spot a pension scammer, as well as the many other kinds of financial fraudsters out there. Particularly in tragic and turbulent times, like those we have lived through in the last 18 months, these horrible people will look to take advantage of the chaos to line their own pockets.

We want to make sure you keep your money safe, by pointing out some red flags to look for if a scammer contacts you about your pension or any other financial matter. Check out our tips below, and if you ever feel like you might have been caught out by a pension scammer contact us right away so we can help secure your finances.

4 Ways to Spot a Pension Scammer

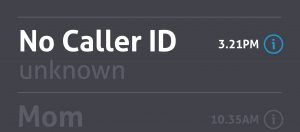

1) Unexpected Contact

If we need to discuss your pension or investments with you, we will always try to schedule a set time and date. Nobody at Lomond Wealth would expect you to be free to talk and to have all your pension information available when we call unannounced.

While a scammer could try to set up a meeting too, they tend to be more opportunistic. If someone calls out the blue, even if it sounds like it could be us, there is no harm in hanging up and calling our office or your advisor back directly.

2) The Carrot or The Stick

Scammers are often in a hurry and will try to rush you. This is so you don’t have time to consider if it is a scam or not. They usually do this in one of two ways, the carrot or the stick. Watch out for promises like “access your pension before the age of 55”, or threats like “you owe HMRC tax”.

They want you do think that “If you don’t take action now…” you will either miss out on a opportunity or be hit with a penalty. ‘Take action’ could mean giving them details, sending them money, clicking on a link etc. We will never rush you or pressure you into taking any action. Hang up immediately or delete that email you received.

3) Unusual Background Noise

This is trickier than it used to be. Before Covid, if you heard a dog barking or kids yelling in the background it would be a dead giveaway that something wasn’t right. But nowadays, scammers might try to play the ‘working from home’ card.

At Lomond Wealth, we are already returning to the office and plan to be there as much as possible going forward – especially when planning meetings with you. However, if you are ever in doubt, again just hang up and call us back.

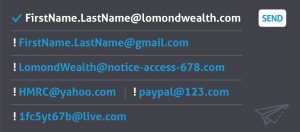

4) Email Addresses & Links

Scammers are getting better at disguising emails. They might even pretend to be us, using a copied email signature. But what they cannot do, is copy our Lomond Wealth email address. Whenever you receive an email from us – especially if it has a link in the email – make sure the address it came from ends with @lomondwealth.com.

Don’t just check the name at the top either. Anybody could use a fake name. Make sure you expand the full email address and look for irregular parts to the address, such as some of those in the image above. If in doubt, contact us directly and we will let you know if the email is really from Lomond Wealth.

Stay Safe with the Lomond Wealth MyWealth app

The best way to know for sure that you are genuinely being contacted by us is to download and use our Lomond Wealth MyWealth app.

MyWealth lets you send and reply to messages between us instantly, in a highly secure way. Plus, the app gives you a great overview of your whole financial position. If you don’t have it yet, download it today for free in the Apple AppStore or Google Play.

Stay safe everyone, and we are always here for you.