Time to maximise your end of tax year savings!

Another tax year has flown by and it’s time to top up your pots to maximise your end of tax year savings! Below is a refresher on how to make the most of your ISA, Pension, Gifting, and Capital Gains allowances, including 6 Top Tips and 3 Crucial Deadlines to watch out for! Get in touch today to take advantage of these opportunities before the deadline!

4 Key Areas To Make the Most of Your Tax Free Allowances

With the UK’s Covid restrictions easing and business picking up again, you may well find yourself in a better position to take advantage of your allowances than this time last year.

Below are 4 ways to maximise your tax-free earnings (including 6 top tips and 3 deadly deadlines that could cost you £1000’s if you miss them).

1) ISA – Load Up Your Individual Savings Account!

As one of the most popular ways to take advantage of your annual tax-free savings allowance, an ISA is something you probably already have. If not, you might want to consider opening one sooner rather than later. Here’s why:

- You can save up to £20,000 per year in your ISA without ever having to pay a penny in tax on the interest you earn, including Capital Gains Tax.

- Some long-term ISA types (Lifetime ISAs or LISAs) give you access to substantial Government backed bonuses of up to 25% when you withdraw to buy your first home, or to retire anytime after 60.

- The LISA 25% bonus is capped at £1,000 per year, so you only need to deposit £4,000 annually to make the most of this offer. Leaving £16,000 of your allowance to deposit in another type of ISA.

- You can also open up Junior ISAs for your kids and deposit up to an additional £9,000 on top of your own £20,000 allowance, until they turn 18.

Cash ISA vs Stocks & Shares ISA

There are numerous ISA types including Fixed, Variable, Instant Access etc. However, whatever the terms are, each ISA (including a LISA) will either be based on either a Cash ISA or a Stocks & Shares ISA model.

As the names suggest, this means the savings you deposit will either be held in cash or invested – each option suiting different types of saver with different goals.

Whether you choose a Cash ISA or a Stocks & Shares ISA will determine how much interest you can earn on your savings, what risk there might be to your savings, how long you keep your money in there, and what fees you will have to pay on the accounts. Both have their own benefits and drawbacks. Talk to us about which one would be right for your goals.

2) Pension Contributions – Grow your pension tax-free while you can.

With the UK’s Covid restrictions easing and business picking up again, you may well find yourself in a better position to take advantage of your allowances than this time last year.

The more you pay into your pension, the more tax relief you get. Simple, right? It really is. You can pay up to £40,000 of your salary into your pension, with tax relief on those pension savings.

By doing this consistently now, over time, this will add up to savings £1000s in tax relief on your pension savings. That’s more in your pocket for when you have time to truly enjoy it, and the peace of mind that you’ll be less reliant on a state pension.

Talk to us about creating or topping up your pension plan to keep more money in your pocket to enjoy when you retire. (We could even help your retirement day come sooner than you’d think!)

3) Gifting Allowance – Don’t look a tax-free horse in the mouth.

Did you know that you can leave behind an estate of up to £325,000 tax free. But for every penny over that, 40% goes straight to HMRC.

In 2020 families handed over a whopping £5.2 billion in Inheritance Tax to the UK Government! So, if you’d rather leave more to your loved ones than the tax man, then read on.

We can help you plan to leave as much security as possible to those you care about. One way to do this is to make the most of your tax-free gifting allowance before the tax year ends. This will allow you to reduce the size of your estate, so that when you pass away your loved ones are not hit with the added pain of a large Inheritance Tax bill. Here’s how it works:

- Gift up to £3,000 per year with no Inheritance Tax.

- Didn’t gift last year? Roll over your allowance to make it £6,000.

- Double up, in a marriage or civil partnership you can both gift from your estate.

- Technically there is no limit on the value of a gift to a loved one – so long as you live 7 years past the date of the gifting, it will not be subject to Inheritance Tax. You just need to make sure you can still live independently e.g. you can’t gift a house and then live there rent free.

Gifting can save £1000’s in Inheritance Tax for your loved ones. But be careful. Misjudging your gifting it can lead to even heavier tax being levied than normal.

At Lomond Wealth, we can help ensure you leave every penny possible to your loved ones, without the risk of over-exposing them to tax or penalties. Get in touch for personalised Inheritance Planning advice and the best gift of all… peace of mind.

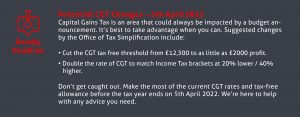

4) Capital Gains Tax – Whatever you do, don’t look down.

Capital Gains Tax offers opportunity and risk. You want to make the most of your allowance but, a bit like walking a tightrope, any misstep will carry a heavy penalty.

One such misstep is to think only the wealthy pay CGT. In truth, you’re liable for CGT any time you sell an asset for a profit. This could be property, art, stocks and shares; almost anything someone pays you more for than you paid for it originally.

Here are some key points to consider for paying CGT:

- You have to pay CGT on anything you sell and make a profit from.

- Your annual allowance is £12,300 profit – if you make less, don’t pay CGT.

- How much CGT you pay is linked to your income tax bracket.

- Basic rate income taxpayers will pay 10% CGT, those in the higher band pay 20%

- However, CGT on property is higher – at 18% and 28% respectively.

Just to make it complicated, there are of course some exceptions. For certain things, you don’t need to pay any CGT when you sell them on, so be careful. Make sure you don’t overpay or, even worse, get hit with a fine for underpaying. Get in touch for clear advice on how to keep all your after-tax profits.

Make the Most of Your Tax-Free Allowances Before the Deadline.

The above advice can significantly grow your wealth if you put it to work correctly. But it’s A LOT of work if you’re trying to keep every penny possible, which you and your loved ones deserve. Expert guidance in these areas literally pays off.

It’s not too late to save yourself £1000s – not just this tax year, but every year to come too. Talk to us about a personalised plan that will make most of your allowances and put those extra savings to work for you.