It’s never too late (or early) to start investing for retirement. Either way, starting today will help ensure a more enjoyable and less stressful lifestyle after stopping work. And there’s never been a better time to do it.

Whether you’re not sure if you’re saving enough, or you haven’t even started yet, we’re here for you. With a personal retirement plan, we can get you on track and help you stay there, just by putting away what you can each month.

Investing? No thanks.

So, investing isn’t for you? Well, we don’t blame you. Investing has a bad image associated with it. High risk, high reward. The rich get richer while poor suckers lose everything.

The thing is. That’s not really true. Forget the Hollywood image of Wall Street. We’re miles away from that – 3,226 miles to be exact. Investing is not a dirty word, and it shouldn’t be a scary one either.

3 Reasons You Should Be Investing for Retirement

1) Bank savings will not save you in retirement

Gone are the days when you could stick your money in a savings account and see any real returns on it. Due to Covid’s economic impact interest rates have been at an all-time low of 0.1% since March 2020. In fact, rates weren’t anything to write home about before Covid – having not even reached a measly 1% since the 2008 crash hit.

It’s smart to have a rainy-day account of around 3 months income to cover emergencies. But the rest of your savings can work much harder for you in a retirement plan.

Unless you’re earning vast sums of money and can save entirely independently for your retirement you’ll never have enough to retire on with bank-based savings alone. And even if you did, you’d actually secretly be losing money every year. Here’s why…

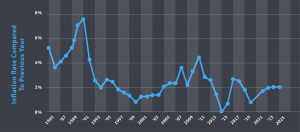

2) Inflation is silently stealing your money

Worried about losing money by investing? Good. Everyone should have a little risk awareness. But did you realise that NOT investing anything means you will lose money anyway?… It’s all thanks to inflation.

Put simply, inflation is drop in the purchasing power your money has over time. As the cost-of-living increases the £1 in your pocket becomes less valuable. Investing can help balance this out by creating additional pennies from that £1 in your pocket – aiming to match or beat inflation rates.

Unless the % interest from your bank is higher than inflation each year, you will effectively lose money on your savings. And right now, interest is at an all-time low.

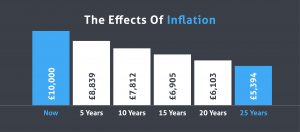

As we just mentioned, if your money has been parked “safely” in a bank savings account, it will not have been growing much, if at all. You might not notice the impact of inflation year to year. But, by the time you retire, this will make a huge impact the lifestyle you can afford with your banked savings.

If you do nothing else, protecting yourself against inflation with a modest investment plan is something everyone should consider.

If left uninvested, £10,000 would effectively be worth £5,394 after 25 years due to inflation.

(Assuming 2.5% inflation per year – it could be higher or lower)

3) There’s an investment style out there for everyone

It’s ok to be a little sceptical or cautious. Investments can go down as well as up. In fact, after decades of helping people reach their retirement goals, the one thing we can say with total certainty is investments will go down sometimes, as well as up.

There is no avoiding an investment going down at some point in time in the short term. But planning for retirement is about long term life goals, not day to day ups and downs.

The world changes constantly. There’s no point looking for a financial advisor who guarantees your investment will go up every day. They don’t exist. (If you find one, run a mile.) Instead, you should look for an advisor who:

- Takes the time to learn about your dreams for retirement

- Understands your tolerance for risk vs reward and explains your options clearly

- Works with you to create a personal plan that fits your goals and timeline

- Stays in regular contact with you so you always understand what’s going on

- And deep down, is someone you feel comfortable with

As a Chartered Financial Planner, this is the kind of advisor we are every day for our clients. Some want a low-risk plan aiming for smaller, steadier returns. Others don’t mind more ups and down, with the potential for greater long-term gains.

But the thing they all have in common is a personal retirement plan that fits their lives, and knowing we’ll be by their side all the way to retirement and beyond.

Don’t put it off. Start now and you’ll thank yourself later.