Investing is a financial tool. But don’t think of it as a hammer. Think of it as a Swiss army knife. It’s not always about increasing wealth. Whatever the position you are in and whatever the goals you have for the future, there is a way to use investing to your advantage.

It’s a common misconception that people looking to invest are looking to get rich – or at least build their pot. But that’s not true in many cases. Rather than maximising the growth of your portfolio at all times, investing is about doing what is right for you financially, whatever point in life you are at.

Here are 3 scenarios that show there is more to investing than aggressive growth.

Scenario 1) Investing to Maintain Value

The aim here is to make sure your portfolio maintains its value over time. Once scenario here could be that you’ve already retired and want to ensure that you won’t have to start cutting out life’s little luxuries in the later years.

Now, maintaining makes it sound like you’re just trying to break even. But this scenario does require some growth. Why? Well, it’s not the number of £s in your portfolio you want to maintain – it’s their ‘Purchasing Power’.

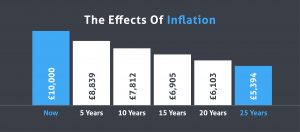

Over time, inflation is going to mean every £ you have is worth a little less. Without any growth, in a few years you’ll really start to feel the difference. So, some growth is needed from your investments, but nothing that could be considered a bid to get rich. It’s simply about managing your money so you can maintain your best lifestyle.

Without investment £10k will only have the buying power of £5.4k after 25 years period, assuming an average inflation of 2.5% per year (it could be higher or lower).

Without investment £10k will only have the buying power of £5.4k after 25 years period, assuming an average inflation of 2.5% per year (it could be higher or lower).

Scenario 2) Investing for Depleting Assets

“You can’t take it with you”, as they say. And for some, there is no need to plan to leave any money behind. Depleting assets is all about making the most of your money while you have the chance. If there is nobody else you want to leave it to, why leave it to the state? You earned it, so spend it.

That said, you don’t want to get caught short. Investing will help you manage your money in a way that allows you to take out as much as you need, without running out. This is not a growth strategy.

While the aim is for your investments to go up in value, the total value of your portfolio will be coming down each year. So that by the end, ideally, your life will be full and your portfolio balance empty.

Scenario 3) Investing to Target a Final Value

For others, there will be reasons to leave something behind. Whether it’s to take care of loved ones or to ensure a cause close to your heart can continue its good work, legacy planning allows you to set a target to aim for.

This scenario is similar to ‘depleting assets’ in that it is not a growth strategy. However, if you want to leave a legacy but still enjoy the same lifestyle as if you were leaving nothing behind, you’ll need to invest a little differently.

Your portfolio will still be going down over the years, not growing. But unless you want to make some cutbacks in your lifestyle, in order to leave a lump sum at the end your will investments will need to go up in value more than someone who is just depleting assets.

Your Personal Approach

Each of these scenarios involve different approaches and tolerances to risk. But all of them use investing as a financial tool for managing your money in key stages of your life. While none of them use investing to actively grow your wealth.

With the right personal approach, investing can help you live life to the full. Get in touch to chat to us about what that means for you.